Answers to Commonly Asked Questions

What is a deductible?

- It is money you pay out of your pocket for medical treatment, services and prescriptions prior to insurance paying your claim.

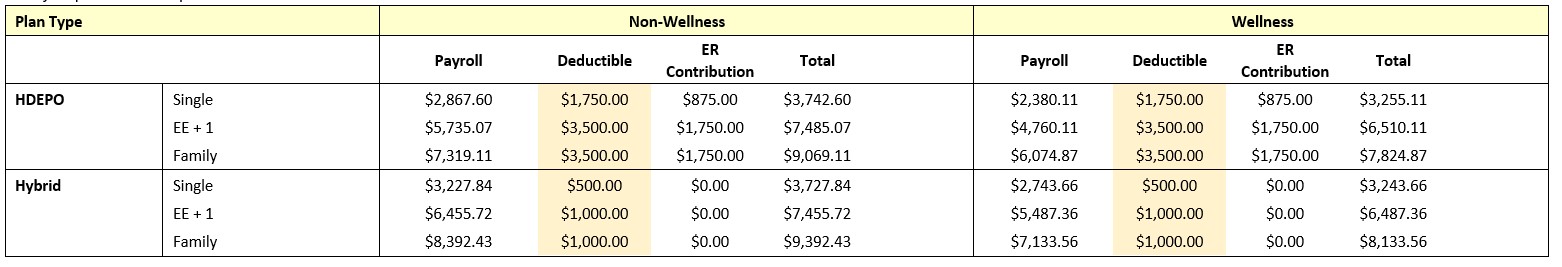

What is my Annual Employee Investment?

Which Plan is the Best Fit for You?

When selecting a medical plan that best fits you and your family, below are some questions to think about:

- Do you or anyone on your plan see a doctor regularly (i.e. primary care, specialist, chiropractor, physical therapist or psychologist)?

- If yes: are the visits monthly, quarterly or annually?

- Do you or anyone on your plan take prescription medication regularly?

- If yes: what is the actual cost of the medication?

If you answered “No” to the above: The High Deductible Plan with HSA may be a great fit for you.

If you answered “Yes” to the above: fore example, you take a monthly prescription medicine that is $12, and you see a chiropractor annually (estimated $25). The Hybrid Plan could suit you best.

What services are considered Preventative Care?

- Adult Physicals

- Well Childcare & Immunizations

- Mammography

- Annual Pap Test & Ob/Gyn Exam

- Immunizations for Adults

- Colonoscopy & Sigmoidoscopy Screening for Adults

- Bone Density Tests

How much do I pay for Preventative Care?

- Preventative Care is covered in full – No deductibles or copays apply.

How can I reduce the cost of my medical coverage?

- Participate in the Curtis Lumber Wellness Program (see details on the Medical Benefits page)

- Review annual employee investment

- Consider alternate plans – different rates for each available plan